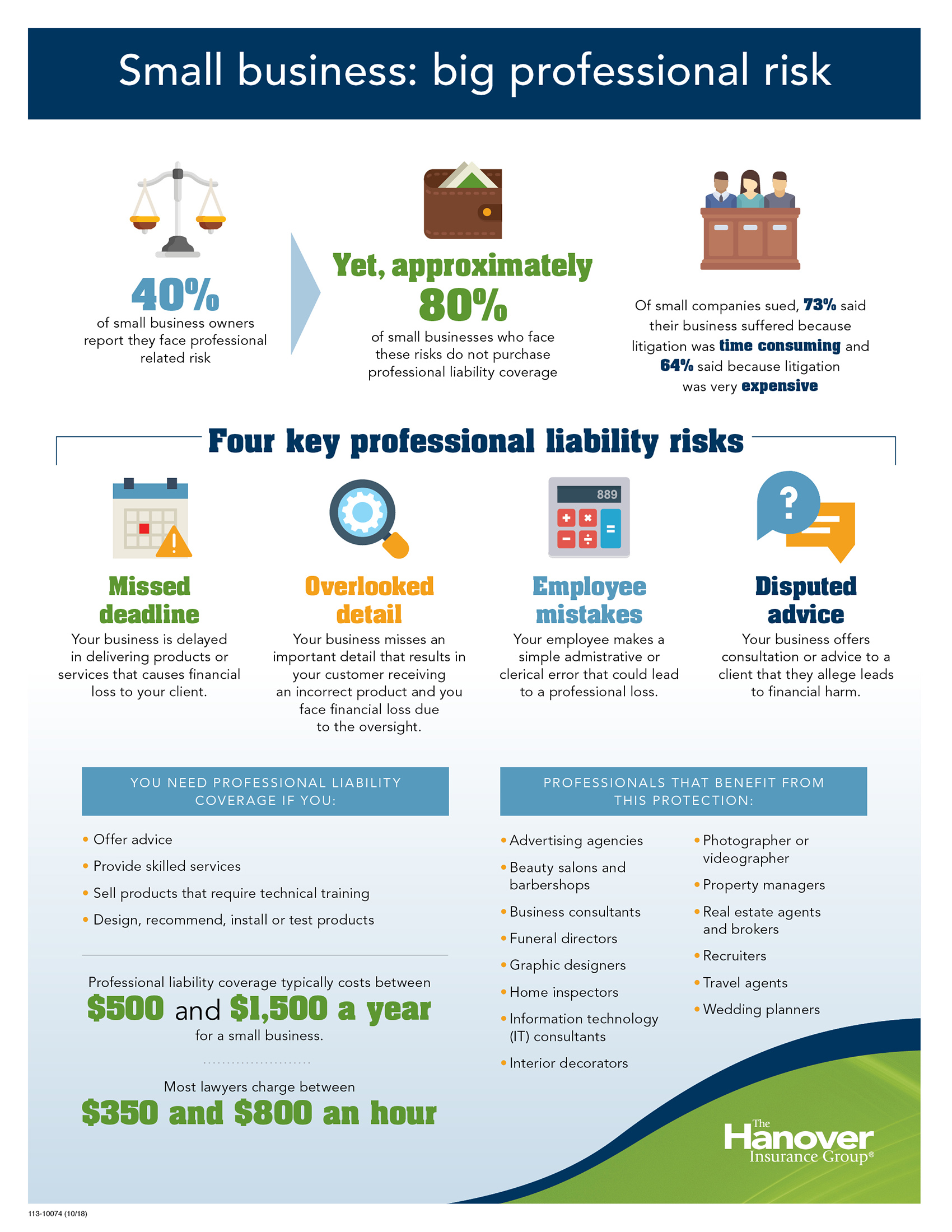

Why small business owners need professional liability protection

Professionals today have a lot to worry about, but the fear of costly lawsuits doesn't have to be one of them. Professional liability, also known as errors and omissions, provides protection for defense costs and settlement payments for allegations that your work or advice was inadequate, contained errors, or failed to meet specifications. Learn more about professional liability coverage and how it gives small business owners added peace of mind.

Sources:

Court Statistics

U.S. Chamber of Commerce

Institute for Legal Reform

Forbes

U.S. Small Business Administration

National Federation of Independent Business

Insurance Journal

All products are underwritten by The Hanover Insurance Company or one of its insurance company subsidiaries or affiliates ("The Hanover"). Coverage may not be available in all jurisdictions and is subject to the company underwriting guidelines and the issued policy. This material is provided for informational purposes only and does not provide any coverage. For more information about The Hanover visit our website at www.hanover.com.

LC June 2018-269